Calculate the Return on Investment in a Rental Property on the Costa del Sol

Why Real Estate Investment in the Costa del Sol Is a Smart Choice: Calculating ROI

Investing to Build Wealth

Increasing wealth is a common goal for investors. Whether it’s saving for retirement or pursuing other financial objectives, generating income is the foundation of all investments. This principle applies across asset classes—stocks, bonds, and particularly real estate.

Why Invest in Costa del Sol Real Estate?

Property investment in the Costa del Sol is an excellent example of a real estate strategy. Investors typically aim to profit from rental income and property appreciation (equity gains). Equity value refers to the increase in property value over time, realized upon resale.

The Importance of ROI in Real Estate

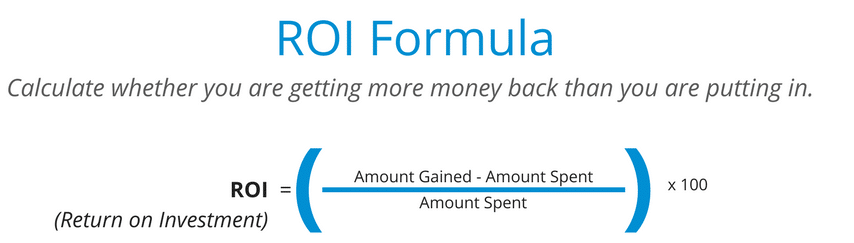

To evaluate the profitability of a real estate investment, it’s crucial to calculate Return on Investment (ROI). This metric helps investors compare opportunities and make informed decisions. Let’s explore how to measure ROI on rental properties in the Costa del Sol and why it matters.

What Is Return on Investment (ROI)?

ROI measures the efficiency of an investment by comparing net profit to the initial investment cost. A higher ROI indicates better returns relative to costs. It’s a versatile metric, applicable to stocks, bonds, savings, and real estate.

In real estate, ROI calculations can vary depending on whether the property is purchased outright or financed through a mortgage. Let’s dive into both scenarios:

ROI for Rental Properties: Cash Purchase

Here’s an example of calculating ROI for a rental property bought with cash:

- Property purchase price: €250,000

- Remodeling costs: €5,000

- Total investment: €255,000

- Annual rental income: €16,000

- Annual expenses (taxes, fees, etc.): €2,800

- Net annual return: €13,200 (€16,000 – €2,800)

ROI Calculation:

ROI = Net Annual Return ÷ Total Investment

ROI = €13,200 ÷ €255,000 = 5.2%

Note: This calculation excludes potential property appreciation.

ROI for Financed Transactions

Now, let’s examine a property financed through a mortgage:

- Property price: €250,000

- Down payment (20%): €50,000

- Closing costs: €2,500

- Remodeling costs: €5,000

- Total upfront cost: €57,500

Ongoing mortgage costs:

- Loan amount: €200,000

- Fixed interest rate: 4%

- Monthly mortgage payment (principal + interest): €577.70

- Other monthly expenses (fees, taxes, etc.): €233

- Total monthly costs: €810.70

Rental income: €1,333/month or €16,000/year

- Net monthly cash flow: €523 (€1,333 – €810.70)

- Net annual return: €6,276 (€523 x 12 months)

ROI Calculation:

ROI = Annual Return ÷ Initial Investment

ROI = €6,276 ÷ €57,500 = 10.9%

Considering Home Equity

Some investors factor in equity gains when calculating ROI. Equity is the property’s market value minus the loan balance. In this case:

- Equity gained in Year 1: €5,000 (loan principal paid down)

- Total return with equity: €11,276 (€6,276 rental income + €5,000 equity)

Revised ROI:

ROI = €11,276 ÷ €57,500 = 19.6%

Why ROI Matters for Costa del Sol Investments

Calculating ROI helps real estate investors assess profitability and optimize their portfolios. With Costa del Sol’s competitive rental market, stable property values, and growing demand for new developments, understanding ROI can guide better investment decisions.